Little Known Facts About "A Case Study on the Employee Retention Credit: Benefits and Limitations".

In feedback to the financial fallout of the COVID-19 pandemic, the U.S. authorities has carried out a range of measures to help organizations keep afloat. One such procedure is the Employee Retention Credit (ERC), which offers qualified companies a tax credit report for retaining their employees during the course of this challenging opportunity.

The ERC was created as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed right into legislation on March 27th, 2020. The credit rating is intended to deliver economic alleviation to businesses that have been negatively had an effect on by COVID-19 and encourage them to maintain their workers on payroll.

To be entitled for the ERC, employers have to meet specific criteria. Initially and foremost, they have to have experienced a notable downtrend in gross receipts as a result of to COVID-19. Exclusively, they have to have experienced either:

1. A 50% or more significant decrease in disgusting invoices for any calendar quarter in 2020 matched up to that exact same quarter in 2019; or

2. Read More Here or partial revocation of procedures in the course of any calendar quarter in 2020 due to orders from an appropriate governmental authority limiting business, trip, or team appointments due to COVID-19.

Employers can easily claim the ERC for wages paid for after March 12th, 2020 and just before January 1st, 2021. The amount of the credit score is identical to 50% of training wages paid out up to $10,000 every staff member (including health and wellness perks). So if an company spends an worker $10,000 or more in qualified wages during the course of this time period, they can claim a maximum credit report of $5,000 per staff member.

It's necessary to note that if an company obtains a Paycheck Protection Program (PPP) loan under the CARES Act, they are not eligible for the ERC. Having said that, if they did not obtain a PPP lending but are or else entitled for each plans, they might decide on which system to take part in.

Now, let's take a appearance at an instance of how the ERC can profit a business. Presume that ABC Company possessed $200,000 in gross receipts for Q2 2020, matched up to $400,000 in Q2 2019. This exemplifies a decline of 50%, helping make ABC Company eligible for the ERC.

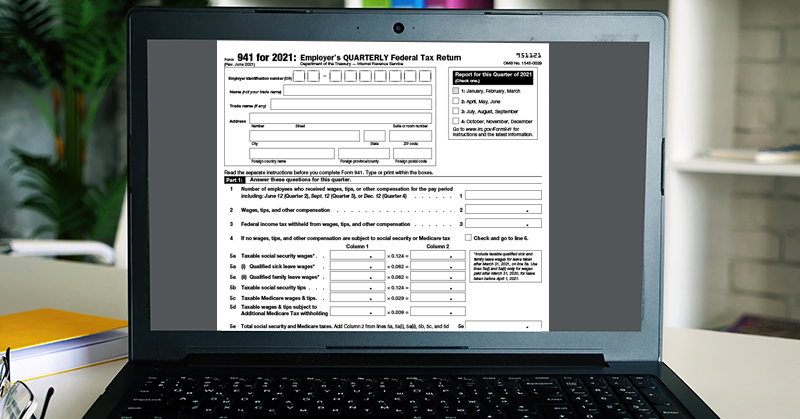

ABC Company has actually 20 workers who each gain $5,000 per fourth (consisting of health perks). To work out their credit, they would grow their complete qualified earnings ($100,000) by the credit rating cost (50%), leading in a credit score of $50,000. This implies that ABC Company can easily claim a credit score of up to $50,000 on their federal government pay-roll tax obligation return for Q2 2020.

It's worth noting that if ABC Company had currently paid their payroll tax obligations for Q2 just before asserting the ERC, they can either file an modified profit or request a refund from the IRS.

The ERC is only one of many measures implemented by the authorities to assist services survive the financial storm caused by COVID-19. By taking benefit of this credit scores and various other relief programs readily available to them, organizations can not merely survive but also thrive in the course of these unclear times.